Companies and industries that participated in the survey have cut off One-fourth of their staff (22.5%), many of them temporary and contract-based. 96.7% of the industries/companies that participated in the survey said there was a decrease of 73.8% in production/business. The debt to total assets ratio of the industries/companies was found to be 48.7%. 74.3% of companies/industries have a loan from banks and other financial institutions. 8.7% of companies/industries have a loan from savings and credit cooperative. 12% of companies are running without a loan. 22.5% of employees have lost their job. Most of them are from Hotel and Restaurant sector. On an average 18.2% Salary was reduced by mostly hotel, restaurant, transport, education sector. It will take 9 months for industries and companies to run normally as before. 82.3% of industries and companies have decided to continue the same business after lockdown.

The impact of the current crisis is not temporary but is likely to induce lasting changes in the way that economies operate says, Nepal Development Update (NDU), a report published by World Bank. Recently published NDU indicates that ‘economic support to firms will be important to generate employment and pivot them towards a greener economy while managing debt overhang. In the relief stage time-bound, liquidity support should be provided to the most affected firms to increase employment. The agriculture and tourism sectors could be prioritized, given their criticality for food security and employment. In the restructuring stage, continued support to firms, including through recapitalization, will be needed. Private-sector recovery can be supported through targeted investments in digitization and by providing fiscal incentives for green investments. In the resilient recovery stage, efforts need to be aimed at strengthening physical, digital, and financial infrastructure to develop e-commerce platforms, enhance access to finance and promote green growth.’

According to WB, COVID-19 had three effects on the monetary and financial sector in Nepal-

First, it led to a drop in private sector credit: new loans to the private sector decreased by 64.7 percent between March and May 2020 compared to the same period the previous year, reflecting a slowdown in economic activities and limited service hours of bank branches during the lockdown.

Second, new deposits – driven by individuals – grew by 82.8 percent, reflecting precautionary savings and a deferment of tax payments.

Third, monetary aggregates increased in May 2020 due to substantial growth in net foreign assets as COVID-19 led to a further decline in imports and an increase in foreign exchange reserves.

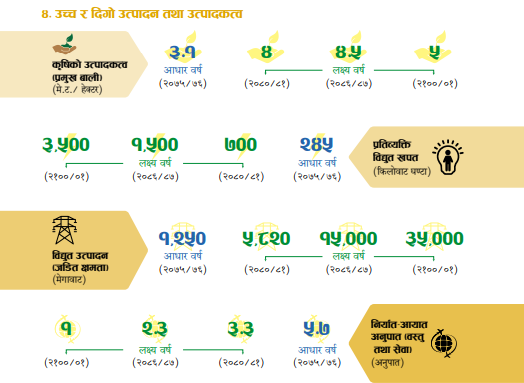

The impacts of lockdown were felt across the economy. Industrial capacity utilization dropped from a pre-COVID baseline of 75-80 percent to 46 percent in June 2020. Daily peak energy consumption, which is closely correlated with industrial production, dropped from pre-COVID level of 1000 megawatts (MW) to 700 MW in June 2020 (NDU/WB). As per the NRB survey, 46.6 percent of companies/industries had 75 percent less energy consumption, 19.2 percent had 50% less energy consumption and 18.1 percent had 25 percent less energy consumption during the lockdown.

According to NDU; remittance has dropped by 43.3 percent between mid-March to mid-May 2020 compared to the same period in previous years. This has affected private consumption and import of goods. There are millions of migrant workers in Arab Gulf countries. Global reports say almost 14% of the world‘s migrant workers live in the Middle East, where they are at high risk of exploitation as they have no guarantee of social security or pensions. The infection rate is highest among migrant workers, many who had already lost their jobs, due to the Coronavirus. Thousands of jobless Nepalese workers have returned home, and many of them are still waiting for the regular international flights to open in Nepal. The return of Migrant workers‘ has directly affected the country‘s economy as returned labor migrants have increased unemployment and created an excess supply of labor in the domestic labor market.

The budget for FY 2021 has announced relief and recovery measures. As per the budget:

A fund of NPR 50 billion will be created to provide concessional loans at the interest rate of 5 percent for the operation of business and payment of salaries for small and medium-sized industries and COVID-19 affected tourism sector.

A discount of 25 percent on the electricity fee for individuals consuming electricity up to 150 units in a month and a discount of 15 percent for individuals consuming electricity up to 250 units in a month. The fee will be waived for individuals consuming electricity up to 10 units a month. A 50-percent discount will be provided on demand charges for industries during the lockdown period.

A provision will be made through the Nepal Rastra Bank (NRB) to provide a refinance facility of up to NPR 100 billion at the interest rate of 5 percent for COVID-19-affected industries in the agriculture, cottage, small and medium-sized enterprise, hotel, and tourism sectors.

The insurance policies of COVID-19-affected industries and transportation will be extended until the lockdown ends. Social security contribution waived for workers and firms during the lockdown period: The government will make contributions (on behalf of workers) to the contribution-based Social Security Fund during the lockdown period. Discounts will be provided on parking fees, airline licensing renewal fees, flight qualification certification charges and the infrastructure tax on aviation fuel.

According to the NRB survey, concessional loans at the interest rate of 5 percent as provisioned in the budget will be a good relief to the industries and companies.

This will motivate the industrialists and entrepreneurs to operate and continue their business without cutting off the number of employees. Concession in interest rate, Flexible EMI, Tax rebate,

Additional loan facility for running capital, Flexibility to extend loan period is few other demands of the industries and companies to survive and continue their business fluently.